Doing business in Kenya

Widely considered the financial and logistics hub of East Africa, and with government reforms continuing to improve the business climate, Kenya is well-positioned to maintain and boost its status as an African economic powerhouse. The country's long-term focus on digital trade, its fast-growing ICT sector, and commitment to infrastructure development, present tremendous opportunities to companies looking to tap into its burgeoning potential.

Listen to the podcastTrade and economic overview

Having been hit hard by the shock of Covid-19, Kenya's economy is showing signs of making a strong comeback. Containment measures to limit the spread of the virus, and the disruption to global trade and travel, meant that economic activity contracted significantly in 2020. But according to a report from the Kenya National Bureau of Statistics1, published in October 2021, real GDP grew by a robust 10.1% in the second quarter of 2021 compared to a contraction of 4.7% in the same quarter of 2020. The report says that economic activity and growth was driven by an easing of policy measures and supported by sectors including information, communications and technology (ICT, which recorded 25.2% in Q2 last year), transportation and storage (16.9%), financial and insurance activities (9.9%) and manufacturing (9.6%).

“This performance is encouraging and signals positive and progressive recovery from the effects of the Covid-19 pandemic on the Kenyan economy,” said Kenyan Treasury Cabinet Secretary Ukur Yatani in a press statement in early November. Kenya is an anchor economy in East Africa, which was the only region on the continent that escaped a recession in 2020, growing at 0.7% in 2020, compared with the continental average of -1.8%, according to African Development Bank (AfDB) statistics2.

“East Africa's resilience was supported by strong growth in Djibouti, Ethiopia, Kenya and Tanzania, which recorded positive growth supported by more diversified services sectors and sustained public spending on large infrastructure projects,” says the AfDB in an October 2021 report. The bank expects the region's economic activity to recover to an average of 4.1% in 2021, while average growth is projected to hit 4.9% this year.

- Currency in Kenya

- Kenyan shilling

- Ease of doing business

- 56: Ranked out of 190 countries — World Bank: Doing Business 2020

- Economic growth

- 5.6%: IMF forecast for 2021

Intra-regional trade flows and local market strengths

Economic challenges aside, the pandemic also reinforced the importance of building resilient supply chains through strengthening intra-African trade and diversifying economies — areas in which Kenya is already playing a leading role. The UN puts Kenya as one of the top 10 intra-African exporters in 2015–20173, and although the data on the share of intra-African trade in 2020 is not yet available, the World Trade Organization's World Trade Report 20214 indicates that Kenya's trade with other East African Community (EAC) countries during the first six months of 2020 appears to have been more resilient than its trade with countries outside the EAC.

“The impact of Covid lockdowns has been a major contributing factor to the growth in intra-regional and intra-African trade flows, and there has also been an uptick in local production in Kenya,” says Stewart Makura, Supply Chain Finance and Commodity Trade Finance Head, Sub-Saharan Africa, Treasury and Trade Solutions at Citi. “Where previously local companies competed with finished goods from overseas markets, in the absence of those trade flows we saw quite a lot of demand from local manufacturers for bank facilities as they sought to grow their inventory due to increased demand.” Across Kenya, companies were also quick to respond to essential medical goods shortages brought on by the pandemic, demonstrating their potential to meet local demand. “The inadequacy of equipment and other medical supplies led to local innovations to fight the spread of the disease. For example, in Kenya, students from Kenyatta University created ventilators, while researchers from the University of Nairobi designed a local oxygen concentrator,” says the WTO in its report.

The fact that the EAC is recognised as the most integrated bloc among the continent's regional economic communities will stand Kenya in good stead during the much-anticipated roll out of the African Continental Free Trade Area (AfCFTA), which came into effect at the start of last year and aims to create a single market for goods and services and a continental customs union.

“When the AfCFTA becomes more established, companies operating in countries in East Africa — and particularly Kenya — will be well-positioned to seize the opportunities on offer, given they have already had some practice trading cross-border within the region,” says Makura.

The considerable size of the local market — more than 50 million people in Kenya and 177 million in the wider EAC — provides companies with even greater prospects, he says.

“One of the main attractions for companies looking to move into a market is the ability to sell their products locally without having to rely too heavily on exporting. What makes Kenya even more attractive is its young, growing and educated population with a high fluency in technology. Businesses should take into consideration that explosive growth.”

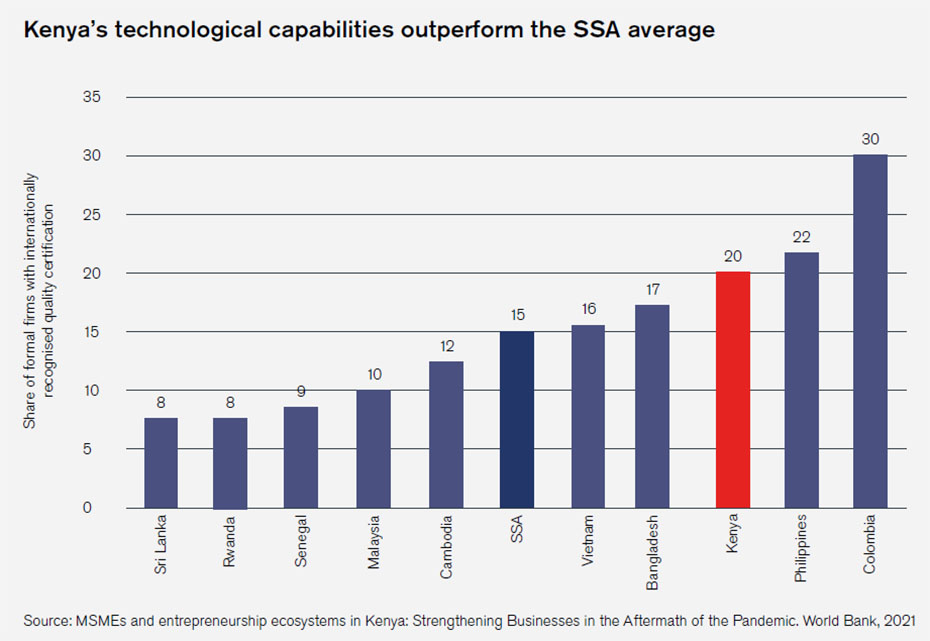

- Sri Lanka

- 8

- Rwanda

- 8

- Senegal

- 9

- Malaysia

- 10

- Cambodia

- 12

- SSA

- 15

- Vietnam

- 16

- Bangladesh

- 17

- Kenya

- 20

- Phillippines

- 22

- Colombia

- 30

Infrastructure development now and into the future

Kenya's competitive landscape is augmented by its outlook for infrastructure development. The Kenyan government continues to invest in public infrastructure development, including road, rail, energy, port and airport modernisation, and prioritise investor-friendly reforms, such as an overhaul of policies and legislation relating to public-private partnerships to realise more infrastructure projects. Amongst the flagship mega-projects already under construction aimed at boosting Kenya's role as a regional logistics hub are the US$23bn Lamu Port-South Sudan-Ethiopia-Transport corridor, a new export pathway that includes the construction of the new port in Lamu, the Standard Gauge Railway, and an oil pipeline, as well as expansion of the port of Mombasa.

The Lamu facility, which began operating in May 2021, is expected to compete for trans-shipment business with existing regional ports such as that of Durban in South Africa, the port of Djibouti, and the port of Salalah in Oman. Kenya Ports Authority acting managing director Rashid Salim has called the port a “game changer in the region”. “The new port brings major changes to freight business,” says Marianne Kilonzi, Trade Product Manager, Treasury and Trade Solutions at Citi in Kenya. “Having access to this facility not only allows Kenya to grow its own economy but also benefits the economies of neighbouring countries.”

Kilonzi highlights work being undertaken by the Kenya Revenue Authority to harmonise export and import processes and procedures, thereby facilitating seamless and cost-effective trade across borders. A recent move includes East African nations integrating their customs systems to make it possible to have a regional bond for goods in transit, she says.

As of June last year, shipping firms and agents operating in Kenya are mandated to use a new Maritime Single Window System to electronically prepare and submit vessel pre-arrival and pre-departure declarations to government agencies at the port of Mombasa. “Digitisation has been at the heart of the government's approach in recent years, including with regards to trade, and this has really been accelerated by the pandemic,” says Kilonzi. “We've seen a lot of efforts, investment and resources put towards digitisation, so that processes can move more quickly and be more transparent.” Policy initiatives aimed at prioritising investment into ICT and improving digital accessibility include the Kenya Vision 2030 and, more recently, the 2019 Digital Economy Blueprint.

Citi's diversified approach

Digitisation needs have permeated the financial sector, driving the adoption of digital banking ecosystems. “Even more so since the pandemic, there’s been a strong demand for digital enhancement,” says Makura, who notes that the use of the CitiDirect BE electronic banking platform, where documents are completed, processed and tracked digitally, has risen significantly. “Over 90% of our customers now transact via the platform,” he says. Elsewhere, the bank continues to expand the diversification of its offering in Kenya, including in support of institutions that facilitate growth amongst SMEs. A recent example involves a US$3mn term loan to 4G Capital, a financial technology credit provider, which is expected to impact more than 25,000 micro-enterprises in the fastmoving consumer goods space, providing them with the necessary liquidity and working capital to keep their businesses afloat.

“We’ve seen our inclusive finance deals grow as we seek to extend our reach beyond the large corporates and further down into supply chains,” says Kilonzi. She explains that there have been several other partnerships with companies – including one that facilitates the provision of solar power, and another that champions women in business – which have served to grow the bank’s footprint in the country and wider region.

“Citi has a very diverse offering in terms of products, ranging from pre-shipment to post-shipment financing, covering both imports and exports,” says Makura. “We also offer working capital solutions, including accounts receivable financing.” Demand for supply chain finance facilities during the pandemic has resulted in a 100% growth in the bank’s supply chain finance book in Kenya, he adds.