How the Private

Sector Is Driving a

Sustainable Future

Val Smith

Chief Sustainability

Officer, Citi

The growing importance of

environmental and social issues has

significant implications for the private

sector. Citi’s commitment to integrate

sustainability across its businesses makes

us well positioned to support clients on

their own sustainability journeys.

Val Smith

Chief Sustainability

Officer, Citi

In the past year, the dialogue on sustainability and climate change has gathered momentum. Extreme weather such as storms and wildfires has seen the public and companies engage with climate change in a more substantive way, while issues such as plastic pollution have also captured people’s attention. Younger generations, such as Millennials and Gen Z, are demanding progress and using their power to influence companies and countries. It is incumbent on policymakers, corporates and investors to follow through with action.

The growing profile of sustainability, especially among corporates, owes much to the publication of the United Nations (UN) 2030 Sustainability Development Goals (SDGs) in 2015 and the Paris Agreement to combat climate change. The SDGs provide the global community with a common language for sustainable development, and create a framework with clearly defined targets. The Paris Agreement establishes a shared ambition around the world for action to limit global warming to well below two degrees Celsius.

More recently, in 2018 the UN Intergovernmental Panel on Climate Change (IPCC) report on the impact of a 1.5 degrees Celsius rise in global temperatures above preindustrial levels and the US National Climate Assessment (describing the impact of climate change on the economy and communities) have illustrated the risks and galvanized action. Perhaps, most importantly, the IPCC report and the National Climate Assessment have helped to shift the climate dialogue from a debate on whether to do something, to a debate on what to do, from policy proposals to technology solutions.

Leading the financial sector’s evolution

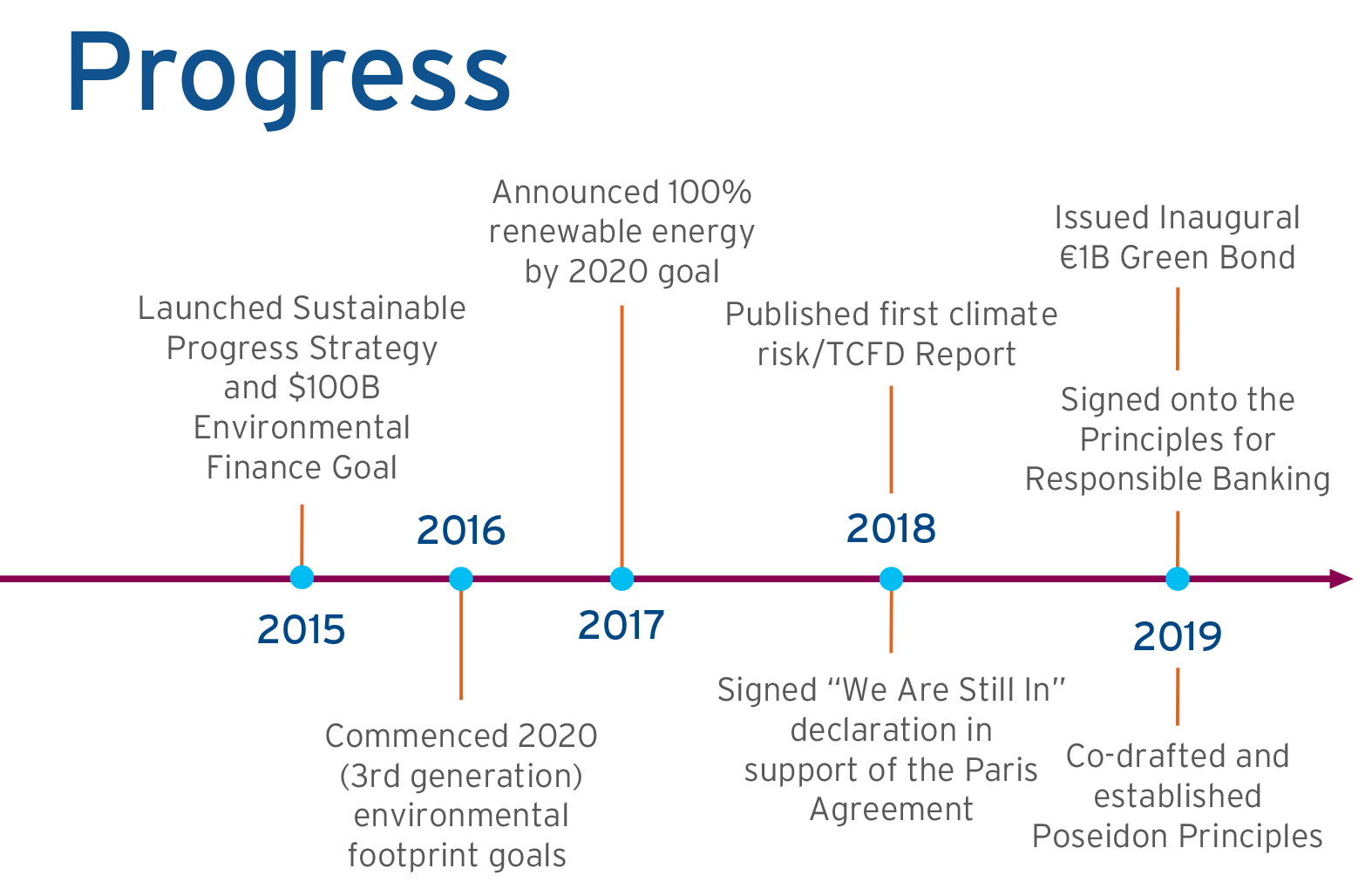

As a global bank operating in over 160 countries and jurisdictions, Citi is uniquely positioned to help clients solve sustainability and climate challenges around the world. The bank has a track record (see Figure 1) of working to create policies and principles that transform the financial sector, such as the Green Bond Principles in 2014, the Principles for Responsible Banking in 2019 to help guide the sustainability transformation of the banking sector, and the Poseidon Principles on shipping finance in 2019 (which were the world’s first sector-specific agreement on Paris Agreement alignment).

Citi also uses its voice to drive advances on key issues such as climate policy. This is reinforced by assertive action; Citi’s $100 billion Environmental Finance Goal, launched in 2014, committed the bank to lend to, invest in and facilitate projects and activities that reduce the impacts of climate change and create environmental solutions that benefit people and communities. The goal was originally intended to run for 10 years until 2023, but was met in full by 2019, four and a half years early.

Citi’s sustainability approach

While Citi has a role to play in all 17 SDGs, we have identified seven — including gender equality, clean energy, decent work and economic growth, innovation and infrastructure, sustainable cities, and climate action — where we have the ability to have a direct impact through how we manage our company and engage with our clients and investors.

Client feedback has informed the development of initiatives, such as the Green Bond Principles and, led directly to opportunities such as our sustainable supply chain financing approach. Meanwhile, Citi also conducts an annual environmental, social and governance (ESG) roadshow to speak with key investors and discuss our policies on talent, diversity, sustainability and climate change and seek feedback on how we assess and disclose ESG information.

The results of Citi’s dialogue with external parties are shared across Citi’s businesses to identify where we have the capabilities to deliver sustainability benefits to our organization, clients and society. Integral to this process is the identification of sustainability opportunities — that can be counted under the Environmental Finance Goal, for instance — and potential risks.

ESG risks are a core part of Citi’s risk management approach and have had a demonstrable impact on activity. As part of a broad environmental and social risk management (ESRM) policy, Citi has established sector standards for a number of high-risk sectors. If clients do not meet the relevant standards, Citi will work to get the client into alignment, or we may not be able to continue doing business with them. For instance, in support of sustainable palm oil, Citi only lends to firms that adhere to the Roundtable on Sustainable Palm Oil. Similarly, our sector standards for both coal-fired power and coal mining focus on key financial, environmental, social risks in those sectors.

Taking action on climate risk

Citi is at the forefront of efforts to improve climate disclosure in line with the work of the Task Force on Climate-related Financial Disclosures (TCFD), which was established by the G20 group of nations to develop voluntary, consistent climate-related financial risk disclosures for use by companies, banks, and investors in providing information to stakeholders. We see the TCFD framework as a critical tool for assessing and disclosing climate risk across our company. To further that investigation, we are evaluating methodologies to measure the carbon intensity of our credit portfolio and to guide engagement and financial solutions for clients seeking to reduce their own carbon impact.

Citi is focused on taking the necessary steps to make our company more sustainable, with the understanding that this will help us to better manage our risks and will create new business value.

Ultimately, Citi intends to implement a robust climate assessment methodology and stress testing regime, so that we can better understand our clients and their opportunities to transition to a more sustainable, low-carbon future. This process is still at an early stage of development; a cross-functional team spanning banking, risk, modelling and stress testing, and sustainability has been assembled and a pilot for transition risk and physical risk scenario analysis has already been conducted. Of course, many clients are far along the road to sustainability and are using sciencebased targets to align their businesses with the Paris Agreement. We have a lot to learn from these clients as well.

Providing support

Corporates will need both traditional finance and innovative new solutions to help them in their sustainability journey. By improving data capture and analysis relating to sustainability, Citi will be ready to anticipate clients’ needs and proactively provide support. Equally important is the need for us to embed sustainability into our culture, so that it becomes a core part of business thinking and our people are creating innovative sustainable solutions to help meet our clients’ needs.

Every business sector has an ESG angle. Citi is focused on taking the necessary steps to make our company more sustainable, with the understanding that this will help us to better manage our risks and will create new business value. Wherever our clients are in their own sustainability journeys, we are making the investments and commitments so that we can help our clients along their paths.