DR ACCESS PRODUCTS

ABOUT CITI DEPOSITARY

RECEIPT SERVICES

INTERNATIONAL

INVESTING TRENDS

REGIONAL TRENDS

GLOBAL DR TRENDS

Trends

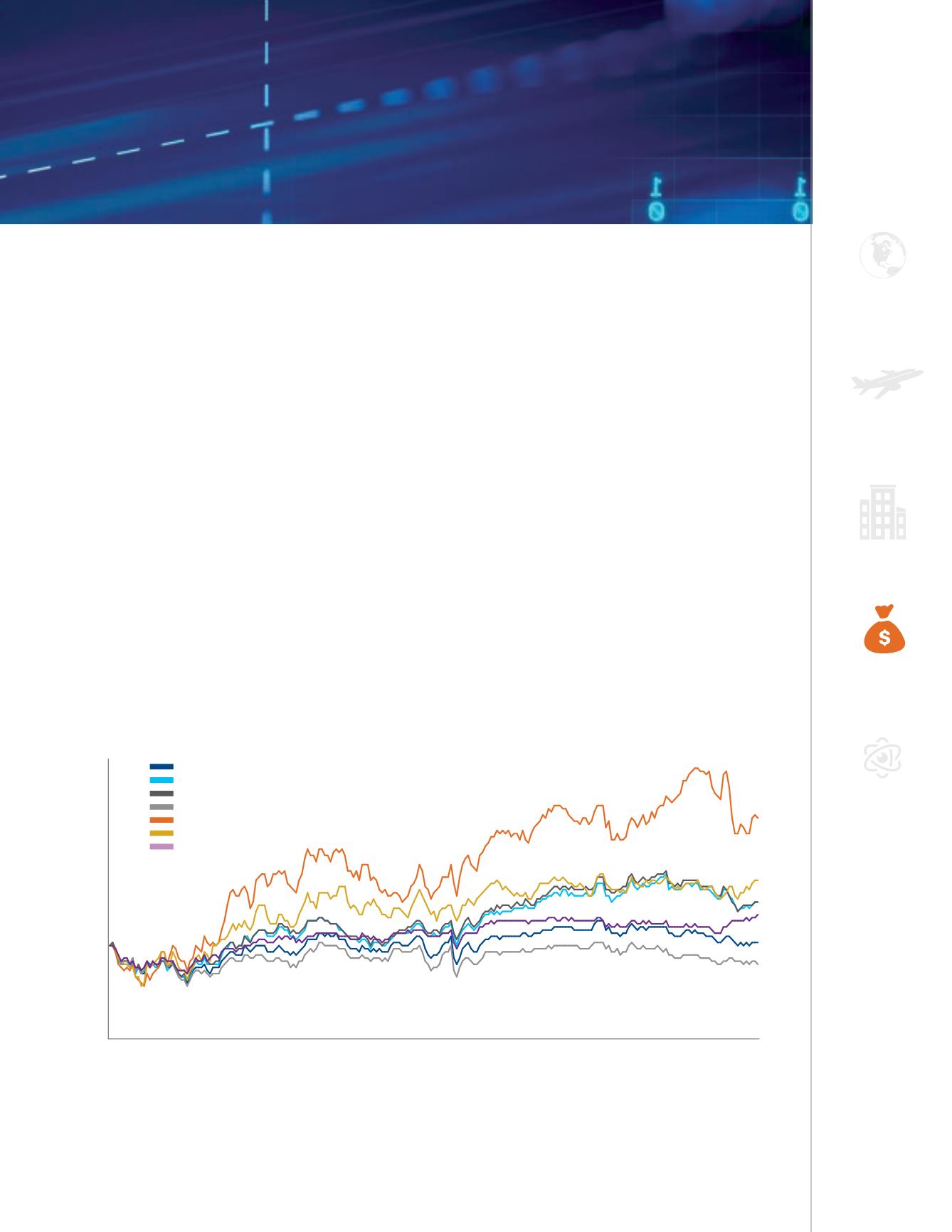

CLDR 2016 Performance

1,2

Source: Bloomberg.

Citi Liquid DR Indices

Citi Depositary Receipt Services maintains the Citi Liquid DR (CLDR) Indices to

provide insight into international investor sentiment towards non-U.S. markets.

The CLDR Indices are free-float, market cap weighted and include only those

companies that have actively traded U.S. exchange-listed ADRs or London-listed

GDRs. The CLDR Indices are distinctive in that they:

• Provide a timely gauge of international investor sentiment towards non-U.S. markets

at the end of the U.S. trading day, considering that all of the constituent equities

trade in the U.S. and/or London time zones.

• More completely capture U.S. and international investor sentiment towards

emerging markets by including London traded GDRs, unlike other DR indices.

• Include one of the few publicly available DR indices for Asia-Pacific ex-Japan and

Asia-Pacific growth economies.

CLDRWXUS Index

CLDRAPAC Index

CLDREAS Index

CLDREPAC Index

CLDRLAT Index

CLDREMEA Index

SPX Index

70

80

90

100

110

120

130

140

150

160

Jan-16

Feb-16

Mar-16

Apr-16

May-16

Jun-16

Jul-16

Aug-16

Sep-16

Oct-16

Nov-16

Levels

1

Data as of December 31, 2016.

2

CLDRWXUS: World ex-U.S. Liquid DR Index; CLDRLAT: Latam Liquid DR Index; CLDRAPAC: AsiaPac

ex-Japan Liquid DR Index; CLDREAS: AsiaPac Growth Economies Liquid DR Index; CLDREPAC: EuroPac

Liquid DR Index; CLDREMEA: EMEA Liquid DR Index; SPX: S&P 500.

Citi Depositary Receipt Services Year-End 2016 Report

39