Treasury and Trade Solutions

|

The Request to Pay Revolution

9

RTP IMPERATIVES

When bank accounts are accessible in real time through

clearing systems and/or Open Banking APIs, a powerful

new layer has been created in the banking infrastructure.

Regulators, merchants, marketplaces, banks and fintechs

need to consider their strategic responses.

Direct digital collections from bank accounts in real time

represents a profound shift in payments but there is a

clear and present danger that they miss the mark from a

regulatory and user perspective. The overriding message

for all stakeholders is to actively engage and not to treat

this topic as a regulatory compliance matter.

• Build schemes on open standards, i.e. ISO 20022

• There should be a sensible risk based approach to

authentication using a combination of methods,

e.g. transaction risk analysis, value limits, trusted

beneficiaries, liability sharing models.

• Consider pros and cons of mandatory bank

participation.

• Consider pros and cons of a centralized clearing

system versus Open Banking (if Open Banking, then

drive standardization).

• Make sure that RTP meets the needs of C2B

merchants and B2B use cases as well as solving for

consumer protection and convenience.

• Consider global best practices, e.g. build RTP and

tokenization together.

• Government departments are large users of

payments systems – they should be early adopters

of RTP to drive consumer acceptance and adoption.

• Enable access by global merchants, i.e. allow RTP

collections into non-resident accounts.

• Engage with the new RTP schemes to make sure

your voice is heard on customer experience and

scheme rules.

• Work with banks and fintechs to address the RTP gaps.

• Test your use cases against attributes of the new

schemes, e.g. current usage of card authorizations,

recurring payments, etc.

• Consider how to reward consumers to use efficient

payment methods.

• Multinational merchants should push for standardized

interfaces to RTP and other real time payments

schemes, e.g. a JSON API implementation of ISO 20022.

Regulators/Governments

Merchants and Marketplaces

1

2

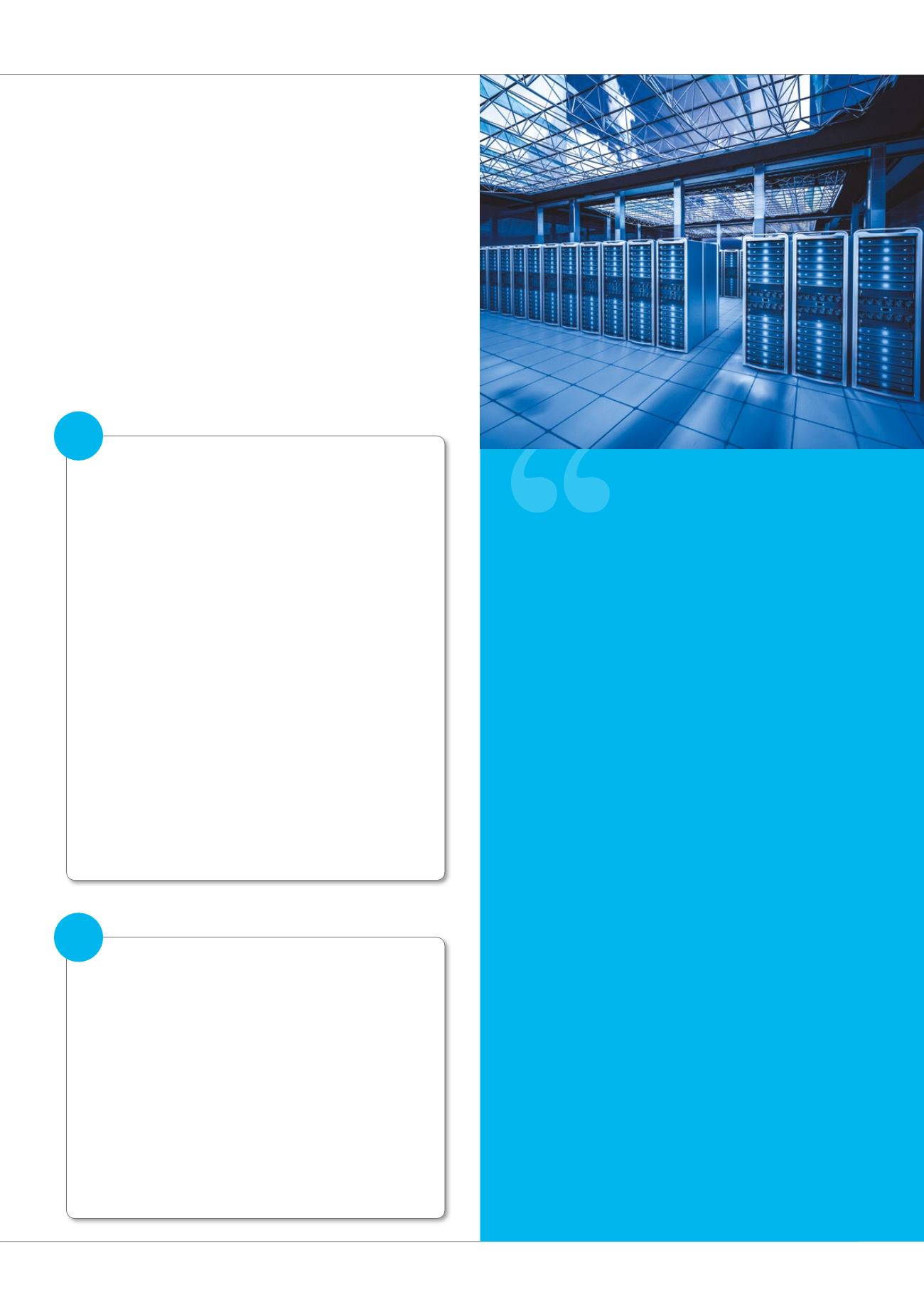

The World Wide Web

Consortium (W3C) develops

open standards to ensure

the long-term growth of the

Web. W3C’s new payment

standards streamline the

checkout experience and

create opportunities to

integrate new payment

instruments like RTP into

Web and mobile commerce.

W3C’s payment standards

create a fast and consistent

payment experience across

browsers and increase

security, for example by

supporting tokenization and

strong authentication.”

Ian Jacobs,

Head of W3C Payments