DR ACCESS PRODUCTS

ABOUT CITI DEPOSITARY

RECEIPT SERVICES

INTERNATIONAL

INVESTING TRENDS

GLOBAL DR TRENDS

Trends

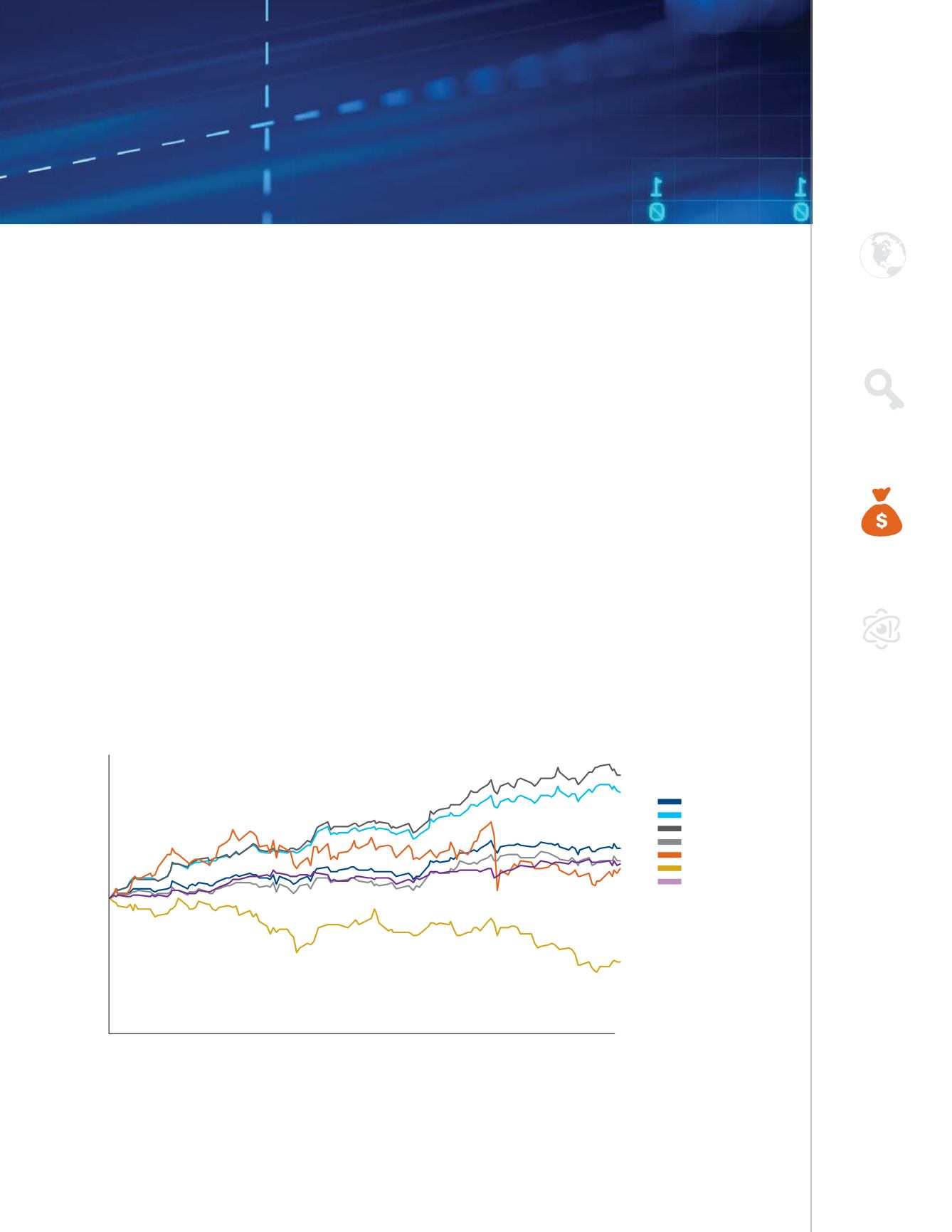

CLDR YTD June 2017 Performance

1,2

Source: Bloomberg.

Citi Liquid DR Indices

Citi Depositary Receipt Services maintains the Citi Liquid DR (CLDR) Indices to

provide insight into international investor sentiment towards non-U.S. markets.

The CLDR Indices are free-float, market cap weighted and include only those

companies that have actively traded U.S. exchange-listed ADRs or London-listed

GDRs. The CLDR Indices are distinctive in that they:

• Provide a timely gauge of international investor sentiment towards non-U.S. markets

at the end of the U.S. trading day, considering that all of the constituent equities

trade in the U.S. and/or London time zones.

• More completely capture U.S. and international investor sentiment towards

emerging markets by including London traded GDRs, unlike other DR indices.

• Include one of the few publicly available DR indices for Asia-Pacific ex-Japan and

Asia-Pacific growth economies.

CLDRWXUS Index

CLDRAPAC Index

CLDREAS Index

CLDREPAC Index

CLDRLAT Index

CLDREMEA Index

SPX Index

70

80

90

100

110

120

130

Jan-17

Feb-17

Mar-17

Apr-17

May-17

Jun-17

Levels

1

Data as of June 30, 2017.

2

CLDRWXUS: World ex-U.S. Liquid DR Index; CLDRLAT: Latam Liquid DR Index; CLDRAPAC: AsiaPac

ex-Japan Liquid DR Index; CLDREAS: AsiaPac Growth Economies Liquid DR Index; CLDREPAC: EuroPac

Liquid DR Index; CLDREMEA: EMEA Liquid DR Index; SPX: S&P 500.

Citi Depositary Receipt Services Mid-Year 2017 Report

31