Global Trustee and Fiduciary Services News and Views | MiFID II Special Edition 2016

35

Transaction/trade reporting

MiFID II/MiFIR requires the reporting of both

trades and transactions. By January 2018,

MiFID II/MiFIR will have imposed a number of

alterations to the previous rules of reporting:

i) MiFID II trade reporting (near-real-time) that

will require firms to report via an Approved

Publication Arrangement (APA). These

reports are near-real-time broadcasts of trade

data for price formation and operation of best

execution obligations. These are reported via

trade reporting venues from where they are

disseminated to the market; and

ii) MiFIR Transaction Reporting (T+1). The

Approved Reporting Mechanism (ARM) regime

will remain in place. However, there are a

number of changes. The number of reportable

fields is increasing from 23 to over 60, the

number of asset class covered has broadened

and the buy-side is no longer exempt.

Q12 Will you be undertaking MiFIR transaction

reporting in-house?

More than half of respondents confirm that they

will be undertaking “in-house” MiFIR transaction

reporting, with a third advising they will not. The

remainder are still to confirm their approach.

In considering the above results, it is important to

note that under MiFID II, all reportable transactions

are to be reported through systems that comply

with specific requirements as detailed in Article

12 of the MiFID Level 2 Regulation. In practice,

what this means is that while a firm can perform

transaction reporting in-house, it will still need to

liaise with an ARM for the report to be submitted to

the relevant national competent authority.

Disclosure requirements

Key areas of MiFID II/MiFIR will require

increased disclosure of information to

both investors and regulators. Areas, for

example, such as:

• Costs and charges (with links to pension

and PRIIPs disclosure requirements)

• Best execution policies

• Product governance and inducement rules

• Recording and record-keeping requirements

• And transaction reporting

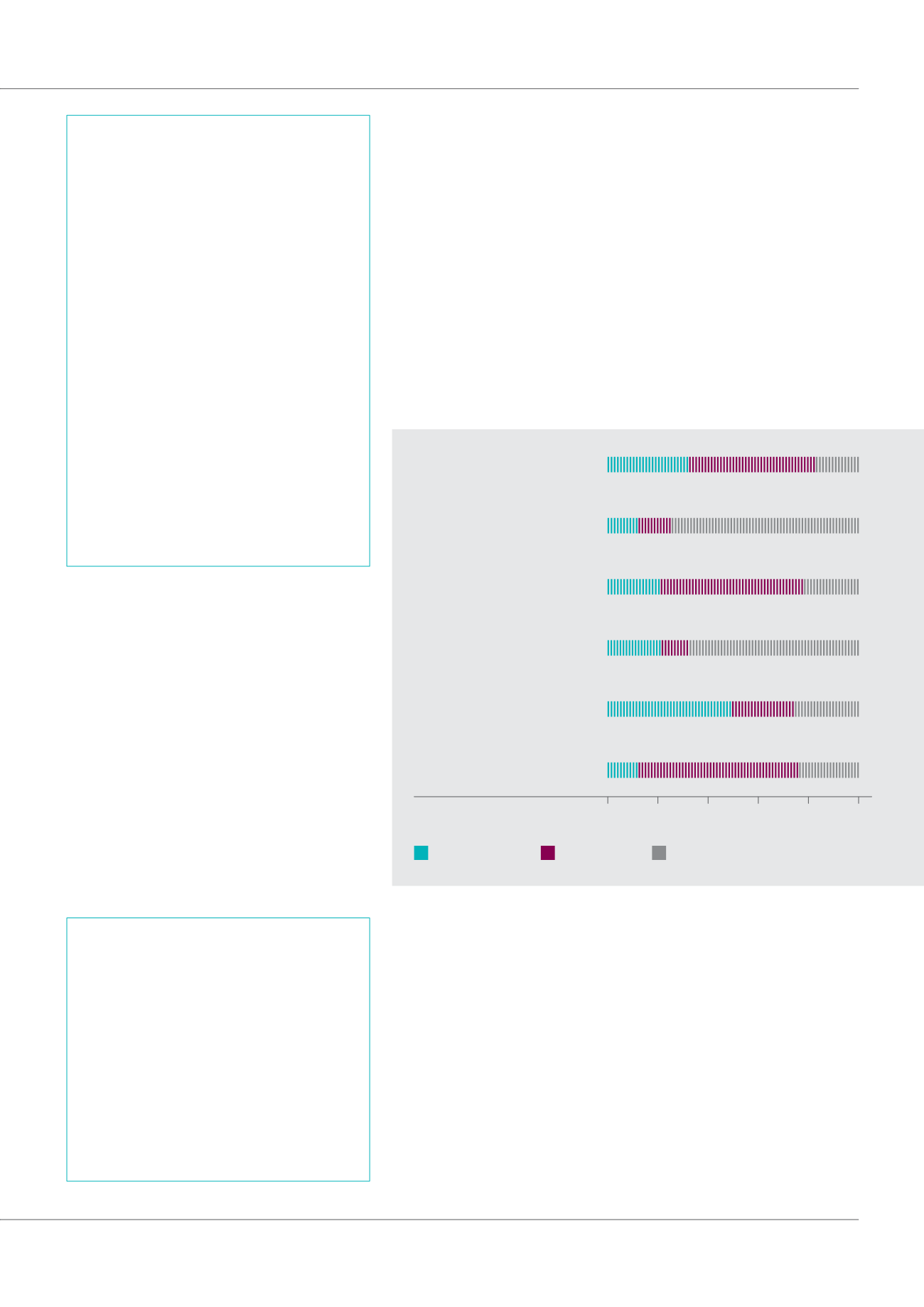

Q13 Will these requirements result in increased

costs and operational changes for your business?

Where the respondents are asked to identify which

requirements will result in both increased costs

and operational changes, transaction reporting

is flagged as the biggest impact with 74%.

Product governance and inducement rule

changes is the next item (67%) where a

large/substantial impact is considered.

In relation to impacts that are considered to have

a moderate effect, costs and charges disclosures

is the highest, ranked at 63%, followed by

recording and record-keeping, at 56%.

Q14 Have these requirements provided any

competitive advantages for your firm?

In the area of competitive advantage (for

these new requirements) asset managers

do not identify any areas that will provide

substantial benefits. Indeed all are identified

as providing either no different or only a

minimal benefit. However, 15% of respondents

say there are moderate competitive benefits

to be found in best execution policies and the

product governance and inducements rules.

Clock synchronisation

Transaction reporting

Recording and recod keeping

Product governance and

inducement rules

Best execution policies

Costs and charges

disclosures

No Difference Moderately

To a large extent/substantially

0% 20% 40% 60% 80% 100%