Global Trustee and Fiduciary Services News and Views | MiFID II Special Edition 2016

37

Q17 Have you engaged across your

distribution chain to ensure that “target

market” requirements can be met?

71% of asset managers confirm that

they have engaged their distribution

chain to ensure that the “target market”

requirements can be met.

Q18 Has this engagement required a better

understanding on your part, as the product

manufacturer, of how the distribution of

your product is achieved?

While 33% of those questioned advise that

this was not an applicable consideration,

an equal number of asset manages confirm

the engagement has led to a better

understanding of how the distribution

of their product is achieved.

Interestingly, a third of respondents also advise

the engagement has not required a better

understanding, although specific reasons are

not provided as part of the responses.

Q19 Will your firm be looking to use any

industry association templates or guidance

to assist you in meeting the target market

requirements?

Three-quarters of respondents confirm that

they will be looking to utilise an industry

association template and/or guidance to

help them in meeting their target market

requirements.

Q20 How long have you been working on

your MiFID II implementation plans?

Less than 12 months

12 month to 18 months

18 months to 3 years

0% 10% 20% 30% 40% 50%

Q21 Will your firm be ready for the MiFID II/

MiFIR go live date in 2018?

With the exception of one response that

marked as uncertain, all other asset

managers confirm that they will be ready

for the revised 2018 implementation date.

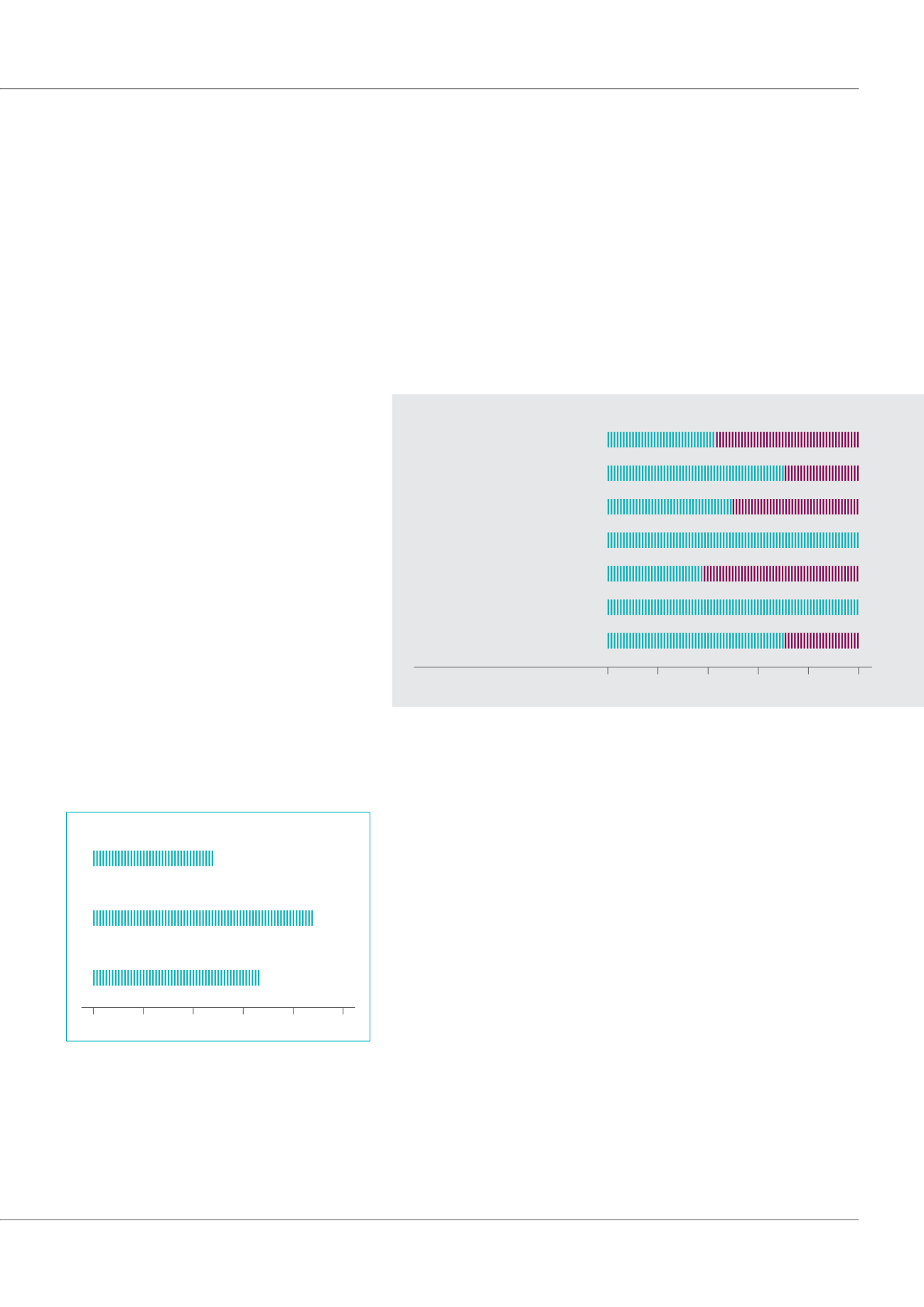

Q22 Have you included other legislative

packages or considerations as part of

your MiFID II/MiFIR project?

Asset managers have also been questioned

on whether, as part of their MiFID II/

MiFIR projects, they have considered other

legislative packages.

Many advise they have not, but the areas

identified by asset managers that have been

included are PRIIPs Costs and Charges (71%),

Brexit: Potential Implications for MiFID II

Passporting Rights (71%), and the Market

Abuse Regulation (50%).

In conclusion

The survey results indicate that firms are still at

varying stages in their implementation planning

and decision-making. Why some of the firms

are not yet in a position to have made any final

decisions about how they will deal with certain

aspects of the requirements is most likely due

to the fact that there have been continuing

delays in finalising the critical details that will

be contained in Level 2 technical standards and

Level 3 Q&A. These are necessary before some

of the final puzzle pieces can be slotted in.

We would like to thank all respondents who

contributed to our survey. We hope that they, as well

as all our readers, find the collated results useful.

Amanda Hale

Head of Regulatory Services

Trustee and Fiduciary Services, Citi

Andrew Newson

Senior Fiduciary Technical Analyst, Citi

General Data Protection

PRIIPs (Costs and Charges)

Market Abuse Regulation

Short Selling Regulation

Securities Financing

Benchmark Regulation

Brexit: Potential Implication

Yes

No

0% 20% 40% 60% 80% 100%