3

Citi Depositary Receipt Services

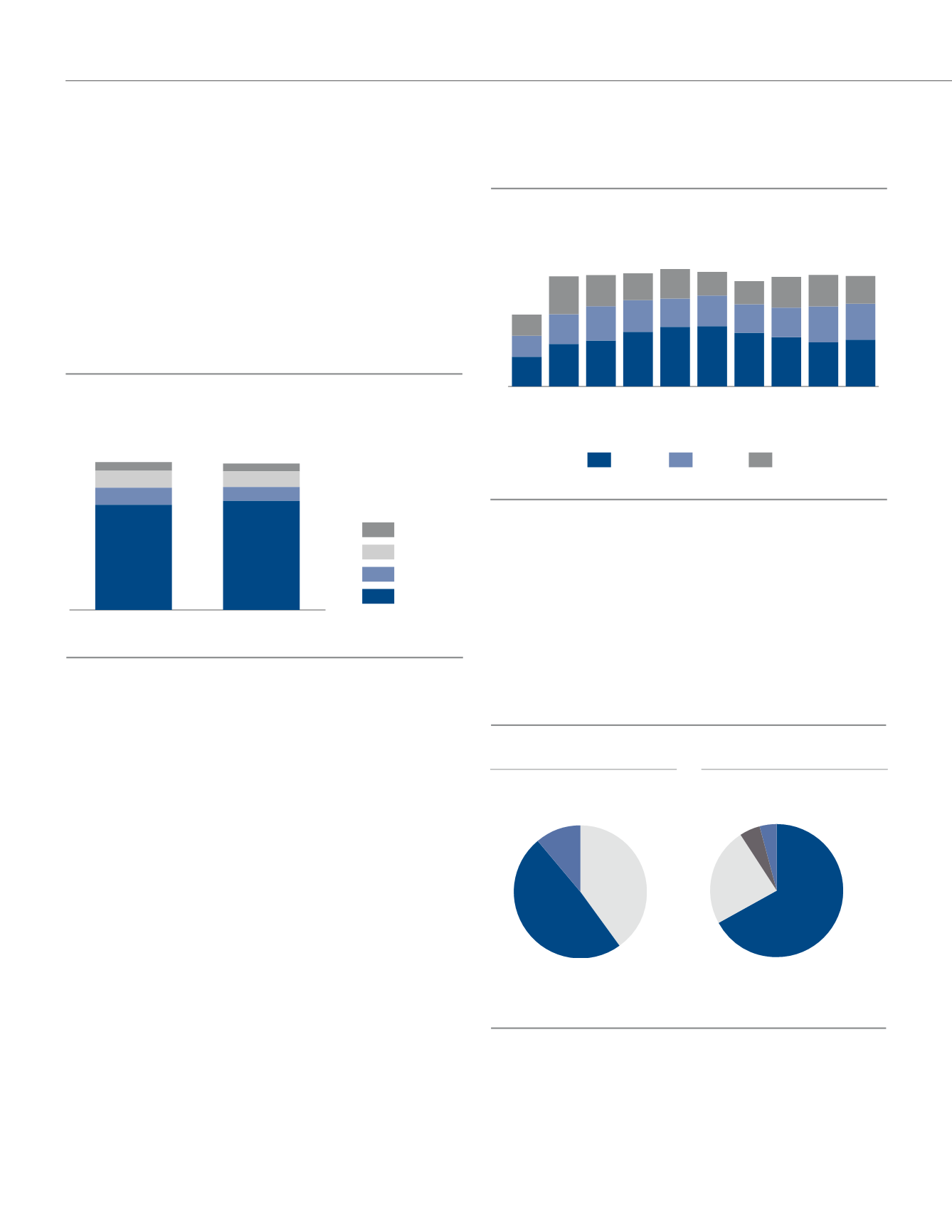

Trends in Regional Trading Volume

1, 2

(in DR billions)

Latam

EMEA

APAC

YTD

June 2016

YTD

June 2015

YTD

June 2014

YTD

June 2013

YTD

June 2012

YTD

June 2011

YTD

June 2010

YTD

June 2009

YTD

June 2008

YTD

June 2007

80.1 79.4

78.7

75.7

82.4

84.5

81.3

80.0

79.2

51.6

25.8

21.2

20.5

21.9

20.4

22.8

24.7

22.3

21.3

15.1

22.6

22.1

16.6

17.0

21.2

19.3

27.2

15.1

33.0

31.7

25.8

19.9

33.7

35.4

38.6

43.4

42.8

39.2

30.6

21.4

Source: Bloomberg and Depositary Data Interchange

Europe, the Middle East and Africa (EMEA) accounted for 42%

of global DR trading volume, followed by Latin America (33%)

and Asia-Pacific (25%). Since 2007, overall DR trading volume

has grown at a compound annual growth rate (CAGR) of 5%,

demonstrating the continued demand for international equities.

Total DR trading value through June 2016 decreased by

$131 billion (8%) compared to the first half of 2015. Lower DR

trading value from NYSE-listed DRs accounted for the overall

decrease in DR trading value.

DR Trading Value

1

Region

Trading Venue

Total: $1.4 Trillion

Source: Bloomberg and Depositary Data Interchange

Latam

11%

EMEA

49%

APAC

40%

OTC

5%

LSE

4%

NASDAQ

24%

NYSE

67%

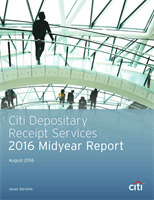

DR trading volume totaled 79.4 billion during the first half of

2016 compared to 80.1 billion during the same period in the

prior year, a decrease of 0.7 billion (1%). Trading activity was

mixed across the major trading venues as the London Stock

Exchange (LSE), NASDAQ and Over-the-Counter (OTC) markets

decreased 1.8 billion, 0.7 billion and 0.5 billion in DR trading

volume, respectively. The decrease was partially offset by a 2.3

billion increase in DR trading volume on the New York Stock

Exchange (NYSE).

DR Trading Volume

1, 2

(in DR billions)

OTC

NASDAQ

LSE

NYSE

YTD June 2016

YTD June 2015

4.3

8.4

7.5

59.1

79.4

4.8

9.1

9.3

56.9

80.1

Source: Bloomberg and Depositary Data Interchange

Lower DR trading volume from Russian issuers (1.7 billion)

accounted for much of the decrease in LSE trading volume.

NASDAQ DR trading volume was down primarily due to a 0.7

billion decline in DR trading volume from Australian issuers.

The reduction in DR trading volume on the OTC market was a

result of lower DR trading volume from Brazilian (0.4 billion)

and Japanese (0.1 billion) issuers. The higher NYSE DR

trading volume was largely due to a 2.3 billion DR increase

from UK issuers.

DR trading volume was mixed across sectors. The

communications, energy and technology sectors declined

by 2.7 billion, 1.8 billion and 1.5 billion DRs, respectively.

The decline in DR trading volume from those sectors was

offset by an increase in DR trading volume in the basic

materials (3.2 billion) and financials (2.3 billion) sectors.

DR Liquidity

1

Data as of June 30, 2016.

2

Amounts may not sum to total due to rounding.