11

Citi Depositary Receipt Services

International Investing Trends

Through May 2016, hybrid funds, which can invest in both

equity and fixed income securities, had an estimated net

outflow of $10.0 billion while bond funds had an estimated

net inflow of $49.2 billion. Compared to the same period in

the prior year, bond funds net inflows were up $3.5 billion

driven by a flight to quality by investors.

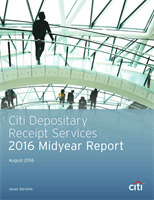

Equity Fund Flows

1

In USD Billions

Domestic Equity

World Equity

-80

-60

-40

-20

0

20

40

60

80

YTD

May

2016

YTD

May

2015

YTD

May

2014

YTD

May

2013

YTD

May

2012

YTD

May

2011

YTD

May

2010

26.9

-14.0

26.9

22.0

-46.7

10.7

57.7

48.5

63.4

-36.9

15.1

7.4

24.9

16.3

-64.1

Source: ICI

Year-over-Year Flows to Long-Term Mutual Funds

In USD Billions

YTD

May 2015

YTD

May 2016

Increase/

(Decrease)

2

YoY

Total Equity

$21.7

($47.8)

($69.5)

Domestic

($36.7)

($64.1)

($27.4)

World

$58.4

$16.3

($42.1)

Hybrid

$11.1

($10.1)

($21.1)

Total Bond

$45.7

$49.2

$3.5

Taxable

$37.2

$22.0

($15.2)

Municipal

$8.5

$27.2

$18.8

Total

$78.4

($8.6)

($87.1)

According to the U.S. Federal Reserve, U.S. investment in

non-U.S. equities as of Q1 2016 was $6.7 trillion, down 5.6%

from the Q1 2015 level of $7.1 trillion. Net outflows of $385

billion accounted for most of the decrease. On a quarterly

basis, U.S. investment in non-U.S. equities in Q1 2016 was flat

versus the Q4 2015 level of $6.7 trillion.

Long-Term Mutual Fund Flows

1

In USD Billions

-30

-20

-10

0

10

20

30

Total Bond

Hybrid

Total Equity

May-16

April-16

March-16

February-16

January-16

-5.0

1.1

21.4

19.0

12.9

-10.6

-5.2

-1.5

-9.9

-23.7

-1.4

8.8

3.2

0.3

-18.1

Source: ICI

Through May 2016, long-term mutual funds witnessed

estimated net outflows of $8.6 billion compared to net inflows

of $78.4 billion in the same period in the prior year. The

decrease was primarily led by net outflows of $47.8 billion from

equity funds and $10.0 billion from hybrid funds, which was

partially offset by net inflows of $49.2 billion into bond funds.

Most of the overall equity outflow was driven by a net outflow

of $64.1 billion from domestic equity funds, which was partially

offset by a net inflow of $16.3 billion into world equity funds.

1

Data as of May 2016.

2

Differences may not sum to total due to rounding.

Source: ICI