6

2016 Midyear Report

| DR Capital Raising

the NYSE. This transaction marked the first foreign equity

offering from Argentina since 2014. Chinese online travel

services provider

CTrip.comInternational Ltd. raised the

most follow-on capital, issuing over $1.2 billion in DRs across

three follow-on transactions. From an industry standpoint,

internet companies accounted for $1.1 billion (47%) of the

total capital raised during the first half of the year.

Despite the decrease in DR IPO activity in 2016, emerging

growth companies continued to dominate the deal count,

representing four out of the five DR IPO deals that priced

during the first half.

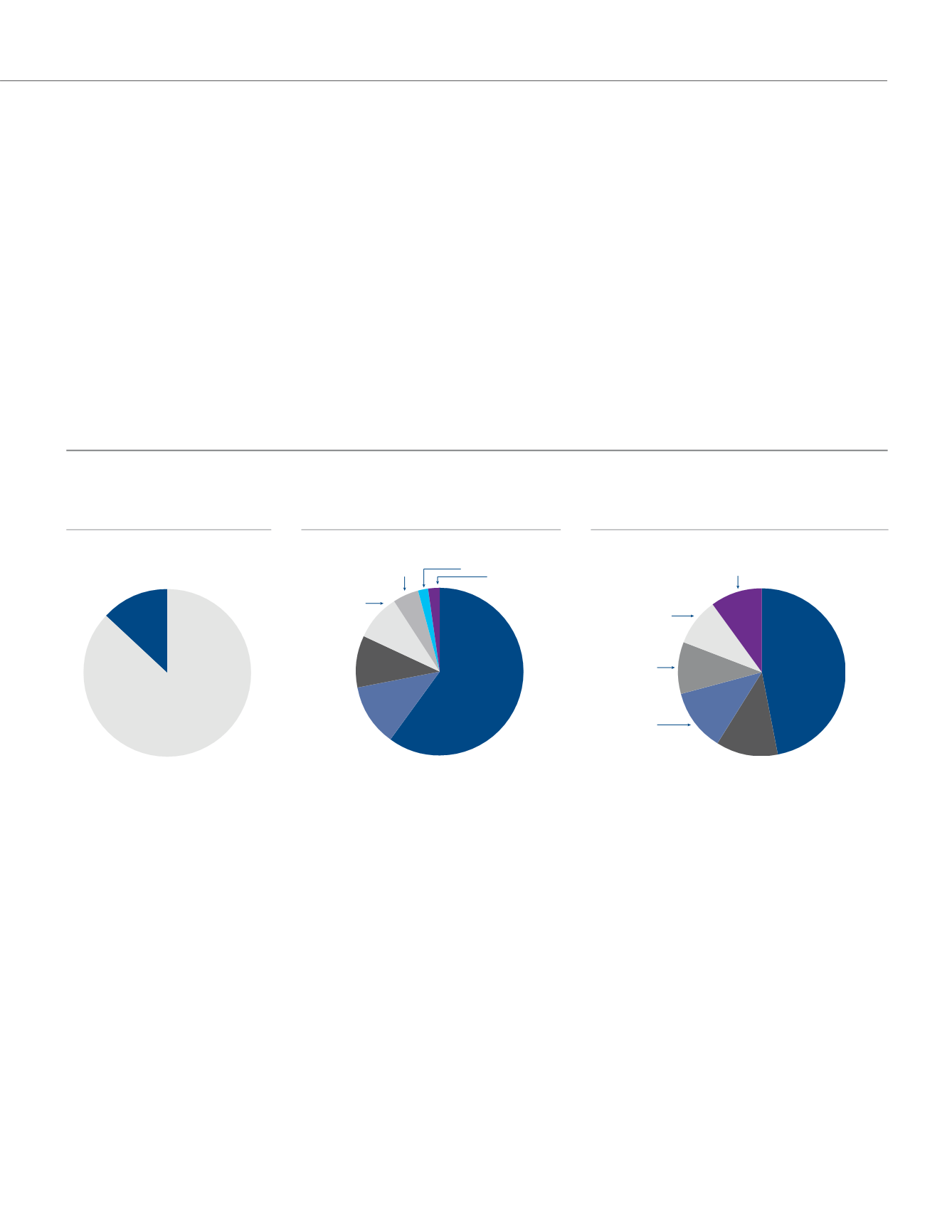

During the first half of 2016, DR capital raising activity

totaled $2.4 billion globally, a 50% decline versus the

first half of 2015. Approximately $747 million (31%) was

raised through initial public offerings (IPOs) and $1.7 billion

(69%) was raised through follow-on and rights offerings.

Regionally, Asia-Pacific led capital raising activity by dollar

value as issuers raised approximately $1.6 billion in new

capital; furthermore, Chinese issuers raised approximately

$1.5 billion (60%) of the total DR capital raised year-to-date.

IPO activity was led by Argentina’s Grupo Supervielle S.A.,

a financial holding company, which raised $302 million on

DR Capital Raising

1

By Type

By Country

By Industry

DR Capital Raising

ADR

87%

GDR

13%

Others

2%

India

2%

Hong Kong

5%

Luxembourg

9%

Russia

10%

Argentina

12%

China

60%

Others

10%

Iron/Steel

9%

Food

10%

Pharmaceuticals

12%

Banks

12%

Internet

47%

Source: Bloomberg and Depositary Data Interchange

1

Data as of June 30, 2016.

Value: $2.4 Billion

Value: $2.4 Billion

Value: $2.4 Billion