Markets and Securities Services | Issue 46

10

charges information. In addition, even when

dealing with professional clients and, in some

circumstances, eligible counterparties, funds

which embed derivative products will require a

more detailed costs and charges breakdown.

The requirements regarding costs and charges will

also require firms to aggregate them into different

categories. The categories are relatively broad,

but even so, retail clients will be able to request a

more detailed breakdown for each category. This

means that asset managers will need to consider

implementing systems and processes to identify,

categorise, calculate and report on relevant

costs and charges within the funds at a much

more detailed level. Asset managers could face

significant challenges in making some of these

disclosures, for example information needed may

not be readily available at the point of the sale of

a fund. Thankfully, the rules recognise that

on a pre-investment basis costs and charges

disclosures can be based on estimates, while

post-transaction costs and charges should

comprise an aggregate and a percentage amount

based on the client’s actual investment amount

and must be made at least annually.

As mentioned, the disclosures should provide

greater transparency and give clients the ability

to better compare multiple products. However,

where a firm is subject to the PRIIPs Regulation

and is relying on making disclosures through

the publication of a Key Information Document

(KID), clients will have distribution costs disclosed

separately. As a result, clients may still struggle

to compare charges on a like-for-like basis. The

implementation date for PRIIPs is set for 31

December 2016 so before then firms will also

need to consider whether they implement a

tactical solution for costs and charges disclosure,

or whether they opt for a full strategic solution

that also covers both PRIIPs and MiFID II

requirements. Potentially, this is an even bigger

challenge for distributors who deal with end

investors and who invest amounts across a range

of products and manufacturers. Distributors

should consider system solutions to obtain actual

costs and charges from manufacturers to be

aggregated on a client-specific basis for post-

investment reporting purposes. The logistical and

system challenges posed by these requirements

may be a further catalyst for distributors

to assess their current product suites and

streamline the number of product manufacturers.

In addition, for UCITS managers the UCITS KIID

does not contain all the information disclosures

required under MiFID II, particularly with regard

to the cost of transactions. Consequently,

asset managers should conduct a review of

their products and disclosure requirements

across PRIIPs, UCITS and MiFID II to identify

the most cost-effective and -efficient systems

and processes to produce and provide these

disclosures to clients and distributors.

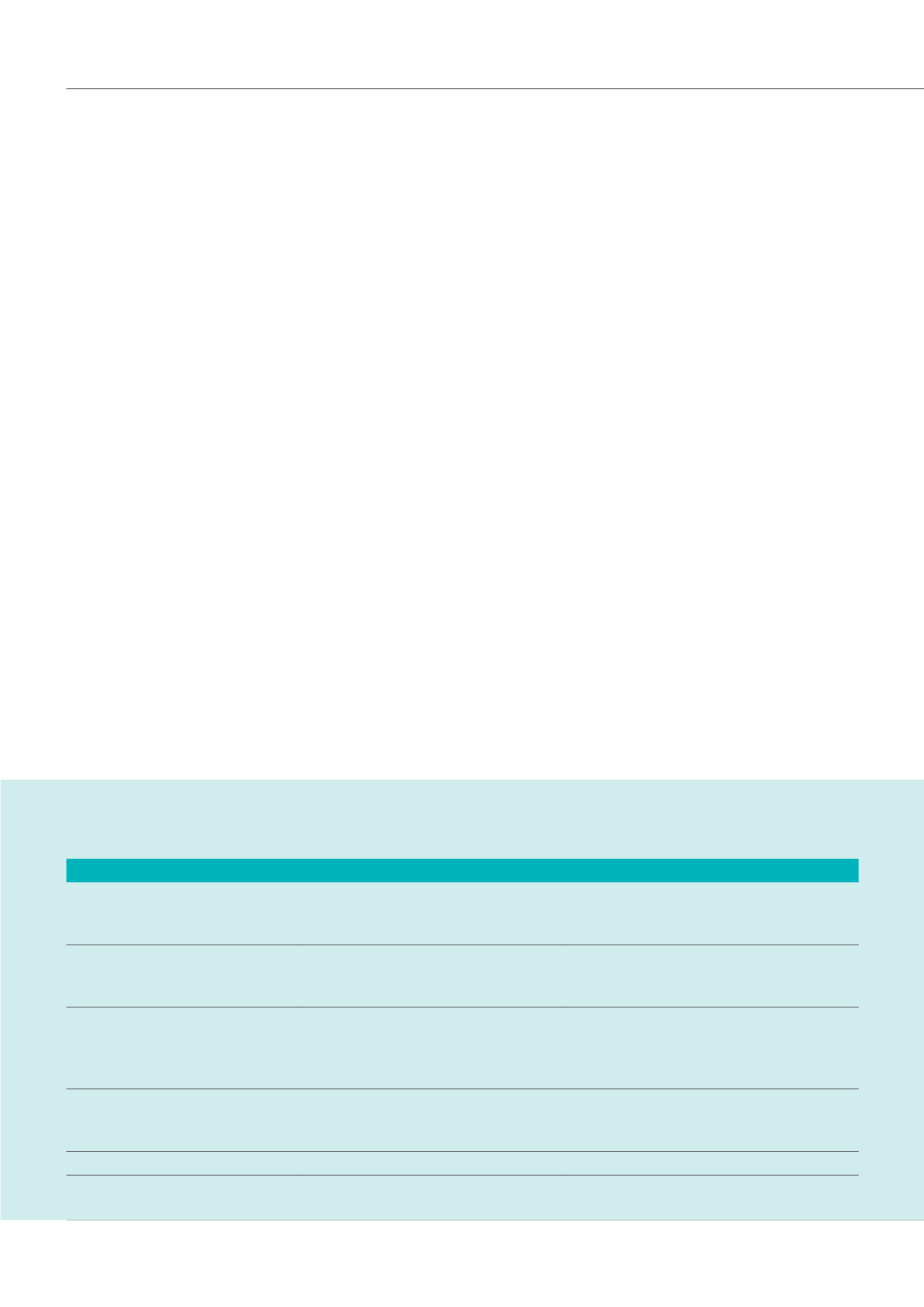

Table 1

All MiFID II costs and associated charges levied for the investment service(s) and/or ancillary services provided to the

client that should form part of the amount to be disclosed

3

Cost items to be disclosed

Examples

One-off charges related to the

provision of an investment service.

All costs and charges paid to the

investment firm at the beginning or at the

end of the provided investment service(s).

Deposit fees, termination fees and

switching costs.

Ongoing charges related to the

provision of an investment service.

All ongoing costs and charges paid

to investment firms for their services

provided to the client.

Management fees, advisory fees,

custodian fees.

All costs related to transactions

initiated in the course of the

provision of an investment service.

All costs and charges that are related

to transactions performed by the

investment firm or other parties.

Broker commissions, entry and exit charges paid

to the fund manager, platform fees, mark ups

(embedded in the transaction price), stamp duty,

transactions tax and foreign exchange costs.

Any charges that are related to

ancillary services.

Any costs and charges that are related

to ancillary services that are not

included in the costs mentioned above.

Research costs.

Custody costs.

Incidental costs.

Performance fees.