Global Trustee and Fiduciary Services News and Views | MiFID II Special Edition 2016

11

Overall, the costs and charges disclosure

requirements under MiFID II are likely to

pose significant organisational and logistical

challenges for most firms. Whether they result

in increased competition based on fees within

the industry remains to be seen. Nevertheless,

the increased transparency should enable

investors to make better informed choices,

and over time less competitively priced product

offerings should become less attractive.

Reporting to investors: quarterly reports

MiFID II will require portfolio managers to

report portfolio losses exceeding 10% to

clients. This will likely require asset managers

to develop and implement systems that can

monitor client holdings and trigger such

notifications. Naturally firms will want to avoid

any potential client panic and/or overreactions

arising from such notifications and so firms

should consider whether such notifications of

portfolio decreases should be accompanied

by appropriate explanations of the loss in

capital value, including the advantages and

disadvantages of holding on to the investments.

Asset managers should look to work with their

fund administrators to develop solutions for

such notifications, which may also require

upskilling and additional resources within

investor communications functions.

Inducements

Under MiFID II, asset managers will be barred

from receiving third-party inducements for

their portfolio management services and firms

providing independent investment advice

will also be prohibited from receiving such

inducements. The UK’s Retail Distribution

Review (RDR) already imposes bans on

inducements for firms providing investment

advice to retail clients (irrespective of whether

this is independent or restricted). However,

MiFID II broadens this ban to portfolio

management services, irrespective of the type

of client. For those UK distributors who do not

provide investment advice and are therefore not

subject to the UK’s RDR regime, MiFID II requires

such distributors who can receive inducements

from asset managers for the marketing of their

funds, to evidence how each inducement would

enhance the service provided to their end

clients. All inducements that do not pass the

quality-of-service enhancement criteria should

not be accepted by distributors.

Moreover, the FCA’s publication of the key

findings from its Inducements and Conflicts

of Interest thematic review re-enforces this

emphasis on being able to evidence specific

enhancements to quality of service and an

appropriate assessment of all aspects of

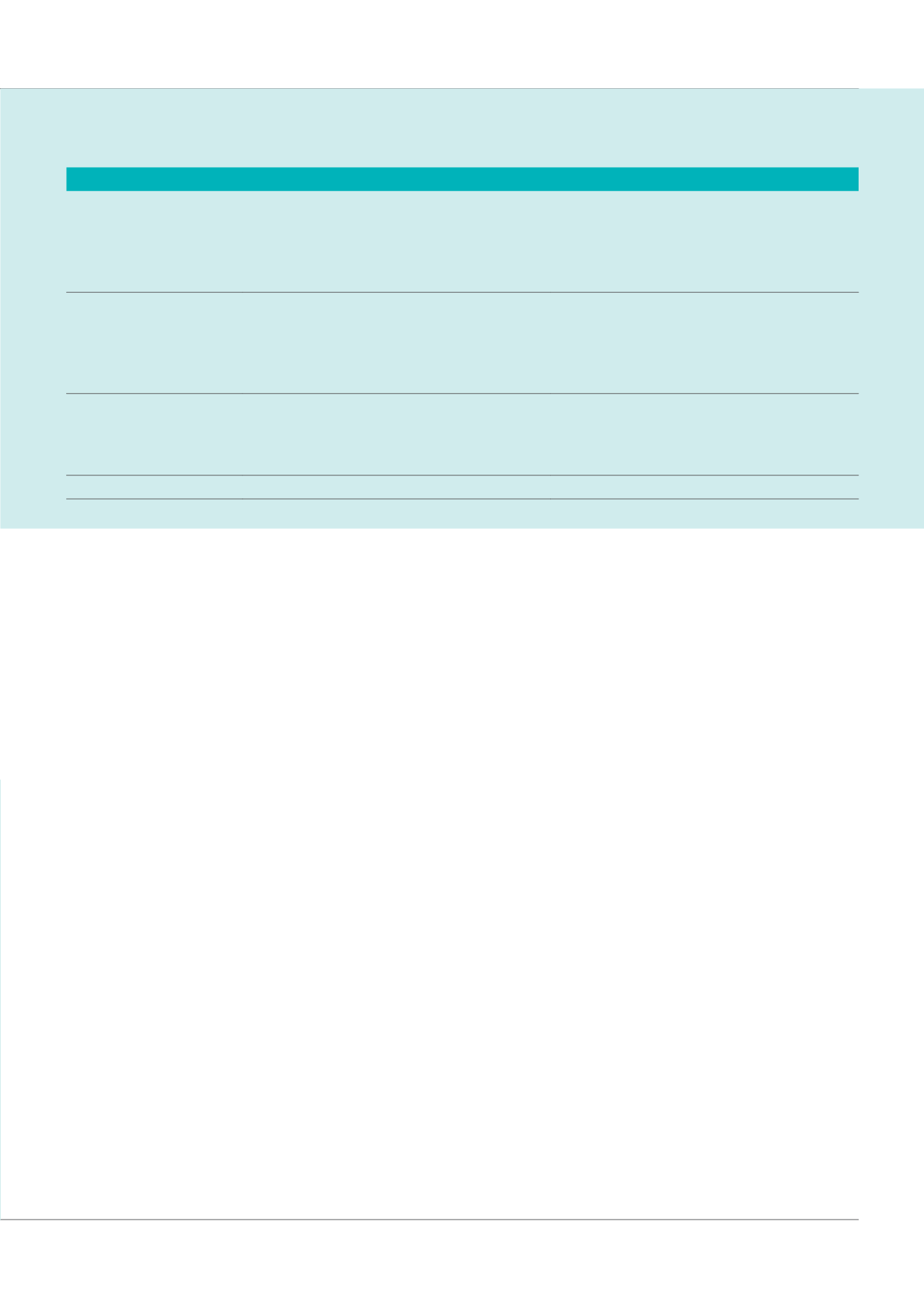

Table 2

All MiFID II costs and associated charges related to the financial instrument that should form part of the amount

to be disclosed

4

Cost items to be disclosed

Examples

One-off charges.

All costs and charges (included in the price

or in addition to the price of the financial

instrument) paid to product suppliers at the

beginning or at the end of the investment in

the financial instrument.

Front-loaded management fee, structuring fee,

distribution fee.

Ongoing charges.

All on-going costs and charges related to the

management of the financial product that

are deducted from the value of the financial

instrument during the investment in the

financial instrument.

Management fees, service costs, swap fees,

securities lending costs and taxes, financing

costs.

All costs related to the

transactions.

All costs and charges that are incurred as

a result of the acquisition and disposal of

investments.

Broker commissions, entry and exit charges

paid by the fund, mark ups embedded in the

transaction price, stamp duty, transactions tax

and foreign exchange costs.

Incidental costs.

Performance fees.