Global Trustee and Fiduciary Services News and Views | MiFID II Special Edition 2016

25

1

The Commission may determine that a third country is

equivalent where the legal and supervisory framework

of that third country fulfils the following:

(a) trading venues in that third country are subject to

authorisation and to effective supervision and enforcement

on an ongoing basis;

(b) trading venues have clear and transparent rules regarding

admission of financial instruments to trading so that such

financial instruments are capable of being traded in a fair,

orderly and efficient manner, and are freely negotiable;

(c) issuers of financial instruments are subject to periodic

and ongoing information requirements ensuring a high level

of investor protection; and

(d) it ensures market transparency and integrity via rules

addressing market abuse in the form of insider dealing

and market manipulation.

counterparties whose derivatives trading

activity is above the clearing threshold set

under EMIR (NFC+s). It also applies to NFC+s

when they deal with FCs or other NFC+s.

The mandatory trading obligation also applies

to FCs and NFC+s when they enter into a

derivatives transaction with third country

financial institutions or other third country

entities that would be subject to the EMIR

clearing obligation if they were established in

the EU (TCEs) — for example, where a UK asset

manager deals with a US-based investment bank.

What will this mean for counterparties in practice?

The mandatory trading obligation for derivatives is

a significant new requirement that asset managers

will need to grapple with — it will potentially require

structural change to booking practices and models

(moving from OTC to venue trading), which, in turn,

may mean new trading terms and other knock-

on impacts for other MiFID obligations, such as

transaction reporting, transparency, etc.

How many and which classes of derivatives ESMA

may declare subject to mandatory trading has

yet to be seen. However, the mandatory trading

provisions in MiFIR rely to a considerable extent on

relevant provisions under EMIR (in particular, the

triggering of the mandatory clearing obligation).

So this is likely to provide a clear line of sight as to

the classes or sub-classes of derivatives that may

become subject to mandatory trading.

Peter Chapman

Senior Associate

Clifford Chance LLP

Jacqueline Jones

Senior Professional Support Lawyer

Clifford Chance LLP

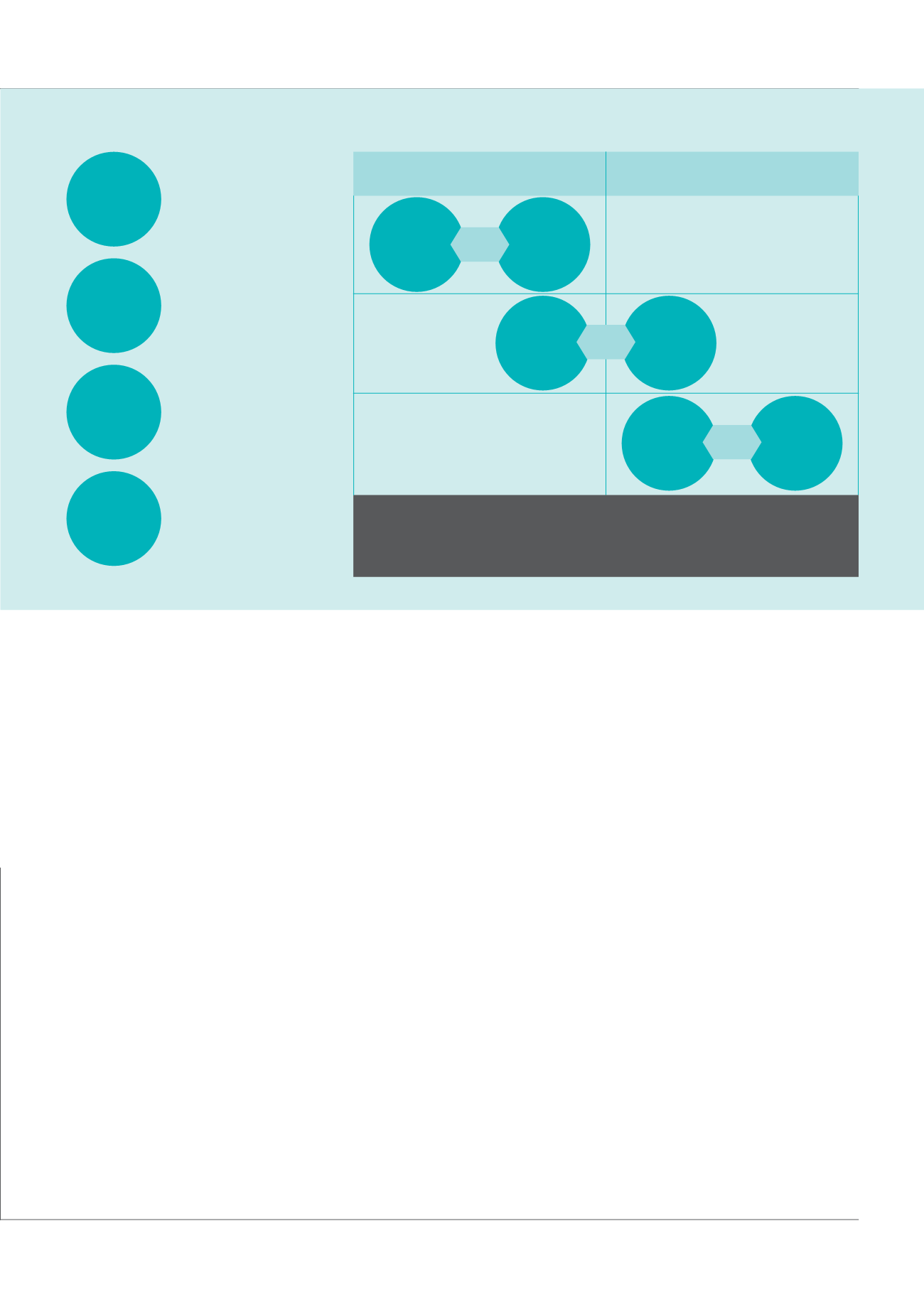

Who is subject to mandatory trading?

Third

country

financial

institution

Third

country

financial

institution

or TCE

TCE

TCE

FC or

NFC+

Non-EU entity authorised

to carry on any of the

activities listed in BCD,

MiFID II, Solvency II, UCITS,

IORPS, and the AIFMD

TCE

Non-EU entity that would

have been subject to

the clearing obligation

if established in the EU

NFC+

Non-financial

counterparty over the

EMIR clearing threshold

FC

FC or

NFC+

FC or

NFC+

Financial counterparty

EU

Non-EU

Only if transaction has a direct, substantial and forseeable effect in the EU

or if necessary or appropriate to prevent evasion.

ESMA’s proposed RTS are aligned with EMIR.

OTC

derivative

OTC

derivative

OTC

derivative