Global Trustee and Fiduciary Services News and Views | MiFID II Special Edition 2016

29

Validation

For core data engines to produce execution

metrics and further analytics output, the platform

must provide controls for record completeness

and data availability. This includes the ability to

define the minimum realisable attributes by asset

class and link client assets to the appropriate

universe of security data (to establish the position

relative to liquidity and block-size thresholds, for

example). To enable the efficient resolution of

discrepancies in data mapping within a bank or

between two counterparties in the event of a trade

break, it will be necessary to have centralised

exceptions management capabilities for enforcing

workflow dependencies related to the availability

of data. These workflows will typically cut across

many individuals and require dashboards that

ensure an accurate view of application state and

processing metrics. The goal here must be to

automate much of the process, from pre-trade

to the publication of data to regulators (and

generating periodic reports analysing trade

performance).

Analysis

A central theme of MiFID I and MiFID II is to

increase market transparency and ensure

efficient and fair price formation. To achieve the

appropriate level of transaction analysis and

trade reporting, mechanisms that accurately

compare activity to market conditions across

asset classes in the context of the prevailing

market environment will be crucial. To provide the

appropriate level of transparency, any compliant

analysis must also be able to map and correlate

trading strategies, portfolio management goals

and the performance of algorithms affecting trade

execution (algorithm-level information is also

required for the reporting process in some asset

classes). Smart workflows to identify variances

or exceptions in trade activity and comparative

metrics to relevant market peers will allow market

participants to use this transparency to inform

execution decisions.

Reconciliation

MiFID II requires users to comply with a series of

prescriptive industry codes and attributes that

may not initially conform to a firm’s internal

standards. Accordingly, processes for matching

counterparties or clients to a centralised legal

entity master, cross-referencing multi-listed

assets with non-unique ISINs and internal

transactions to trade venue identifiers will

require robust reconciliation capabilities.

Reference data

MiFID II demands that every client (fund, account

or natural person) must be identified in a

standardised format. This amplifies the need for

a truly global and central counterparty database

in the context of counterparty checks, where

KYC information and transaction reporting can

be further refined to more efficiently manage

trading risk profiles and systems.

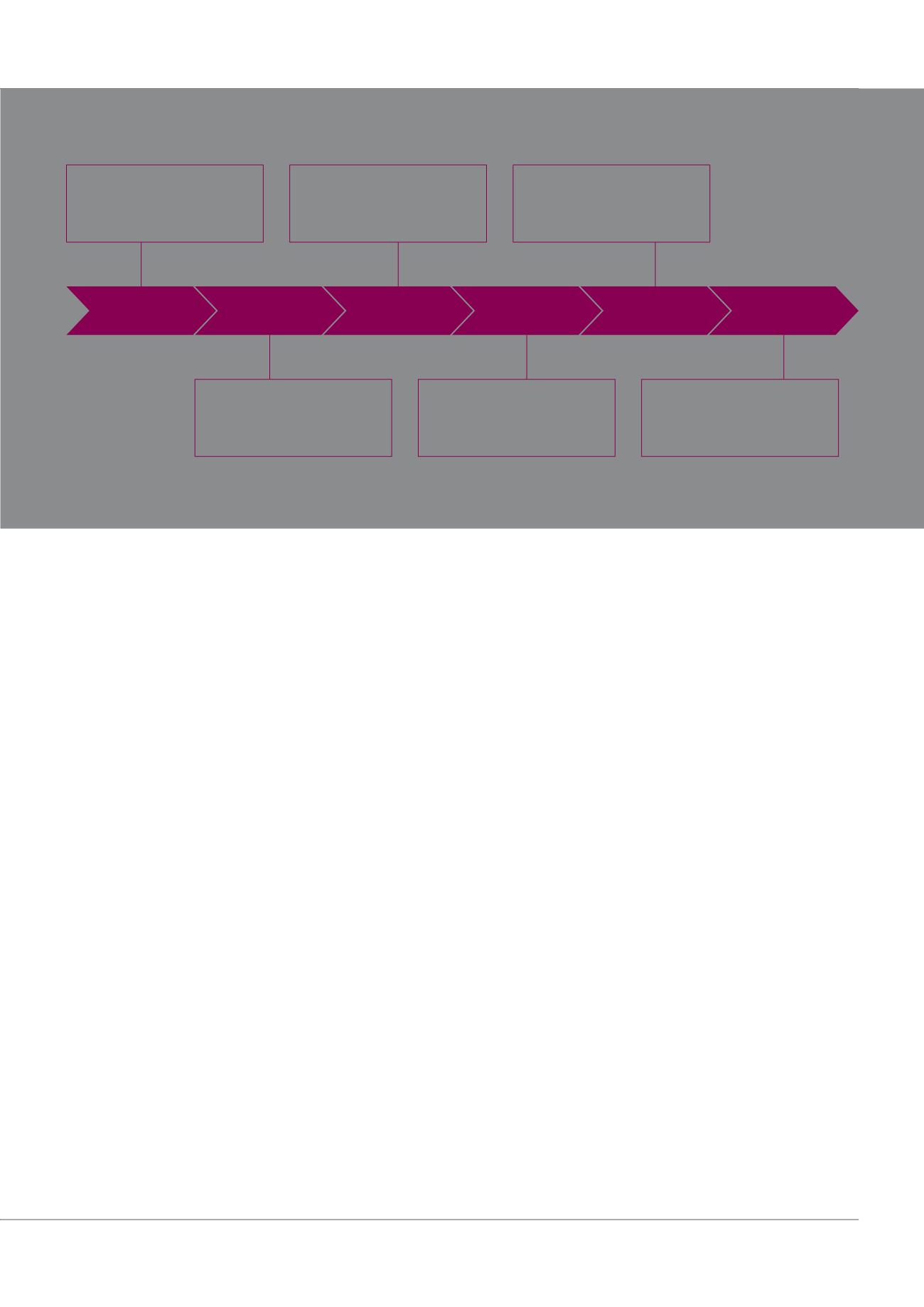

Data sourcing

Validation

Analysis

Reconciliation

Retention

Distribution

Accurately consolidate data

across platforms, markets

and assets classes.

Ensure accuracy and

completeness of records

across asset classes.

Cross-asset engine

for generation of best

execution metrics.

Facilitate matching and

cross-referencing of

identifiers and codes.

Provide searchable store of

activity to respond to audit

and compliance review.

Automate publications of

results to various regulatory

bodies.