Global Trustee and Fiduciary Services News and Views | MiFID II Special Edition 2016

61

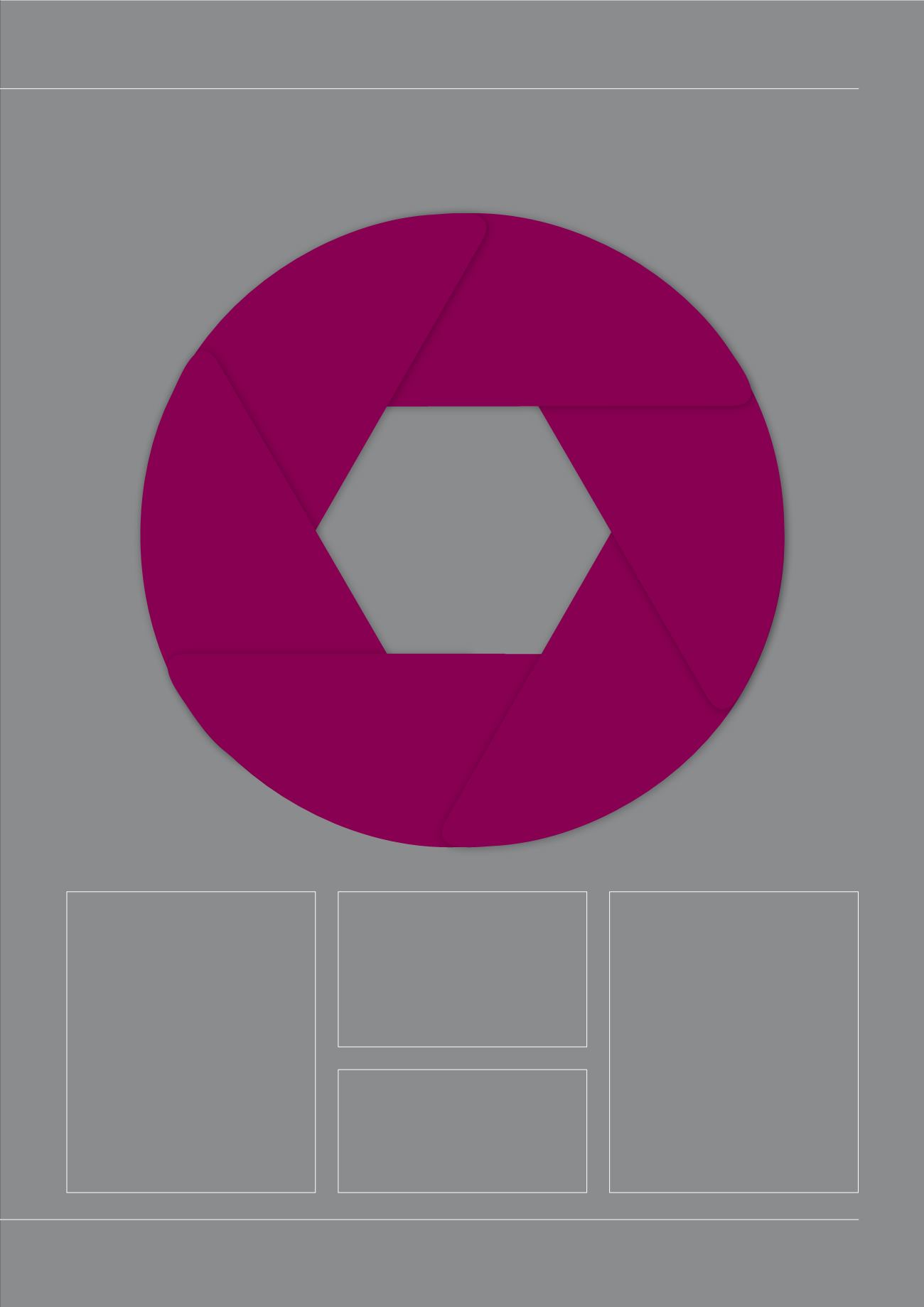

MiFIR: LEVEL 1 OVERVIEW

Scope

Investment firms, credit institutions

(when providing investment

services +/or performing

investment activities), market

operators (including any trading

venues they operate, financial

counterparties and all non-financial

counterparties (subject to EMIR),

CCPs and persons with proprietary

rights to benchmarks, third country

firms providing investment services

or activities within the EU (subject

to applicability test).

Key impacts

Transaction reporting

• Costs

• IT development

• Broker reliance vs. own

reporting.

Delegated acts

• Article 50

Transitional provisions

• Article 54

Exemptions

European Central Banks (ESCB)

excluded in specific capacities.

Regulated markets, market

operators and investment firms

in respect of transactions where

the counterparty is a member of

the ESCB.

Disclosure of trade

data to the public.

TITLES I — III

Trading of derivatives

on organised venues.

TITLE V

Reporting of

transactions to

the competent

authorities.

TITLE IV

Provision of investment services or

activities by third countryfirms following

applicable equivalence decision by the EU

Commission (with or without a branch).

TITLE VIII

Non-discriminatory

access to clearing and

non-discriminatory

access to trading in

benchmarks.

TITLE VI

Product intervention

powers by NCA’s, ESMA

and EBA and powers

of ESMA on position

management controls

and position limits.

TITLE VII

MiFIR

Applies

3 January 2018