Treasury and Trade Solutions

|

The Request to Pay Revolution

2

When implementing an RTP scheme, countries can choose

between two models:

1.

Centralized Clearing system

— a standardized national

infrastructure that provides connectivity to the banks,

e.g. UPI in India.

2.

Open Banking

— each participating bank is accessible

through Application Programming Interfaces (APIs),

e.g. PSD2 in Europe.

These models have their pros and cons — the central

clearing system is harmonized but may be inflexible

for future developments. The Open Banking model is

potentially more extensible to add new services, but runs

the risk of fragmentation unless standards are imposed.

Each RTP system should choose the degree to which

it is centralized and standardized for efficiency and

harmonization without harming the potential for innovation

and being open for new players to participate. The options

are not mutually exclusive — it is likely that centralized

systems and Open Banking will operate side by side in

several markets.

As the infrastructure provider

for several RTGS systems and

the New Payments Platform

(NPP) in Australia, SWIFT

has firsthand experience

in developing new real

time payment systems.

ISO 20022 and APIs are

core technologies, creating

the foundation for value

added services like RTP.”

Stephen Lindsay,

Head of Standards, SWIFT

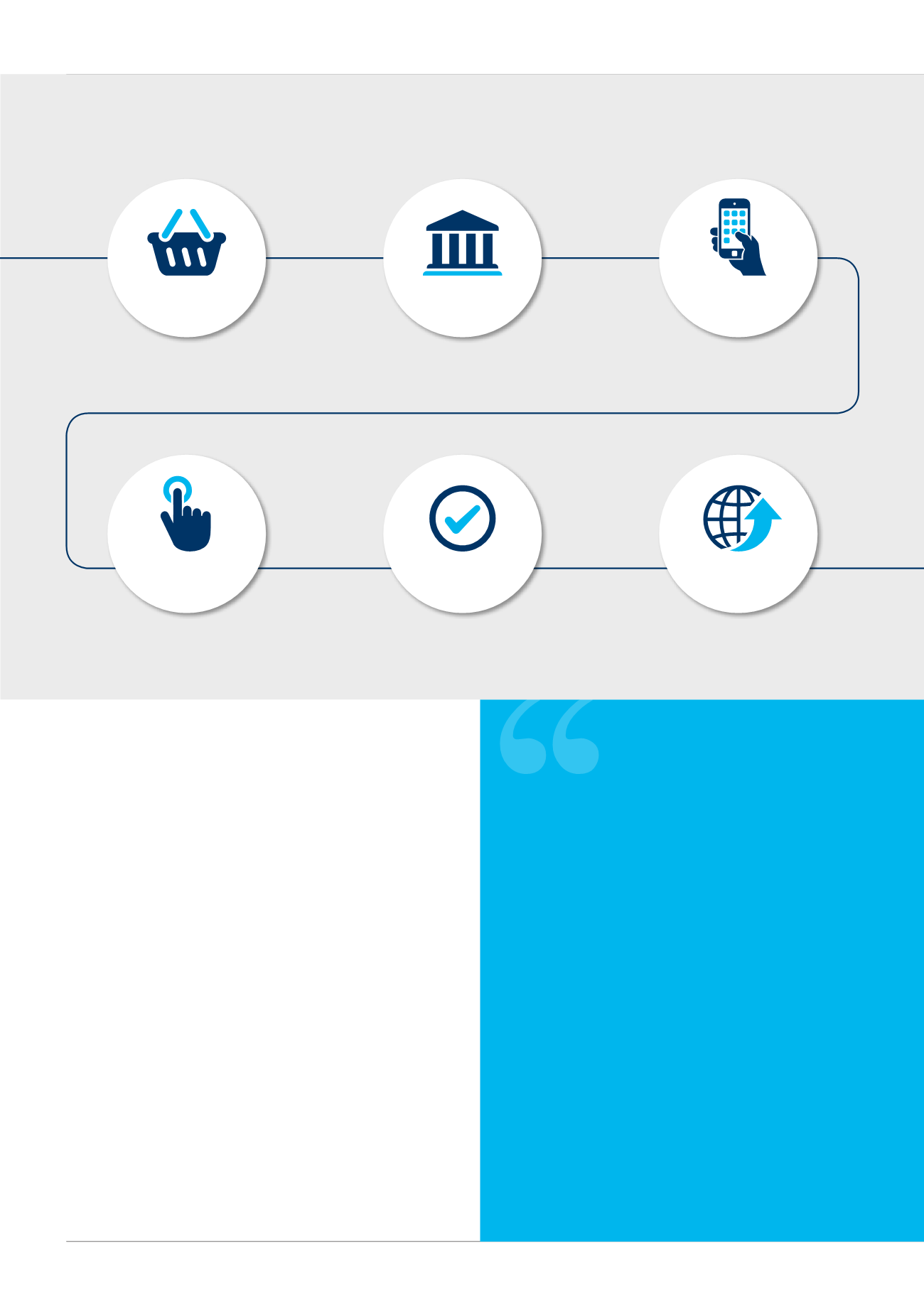

How RTP Works

Checkout

Consumer chooses to

pay by bank

Authentication

Consumer authenticates

with their bank

RTP initiation

Secure payment request

sent to consumer’s bank

Confirmation

Merchant assured of

successful transaction

Consumer consents to

the requested payment

Approval

Payment

Credit transfer from consumer’s

bank to merchant’s bank