12

2016 Midyear Report

| International Investing Trends

International Investing Trends

(continued)

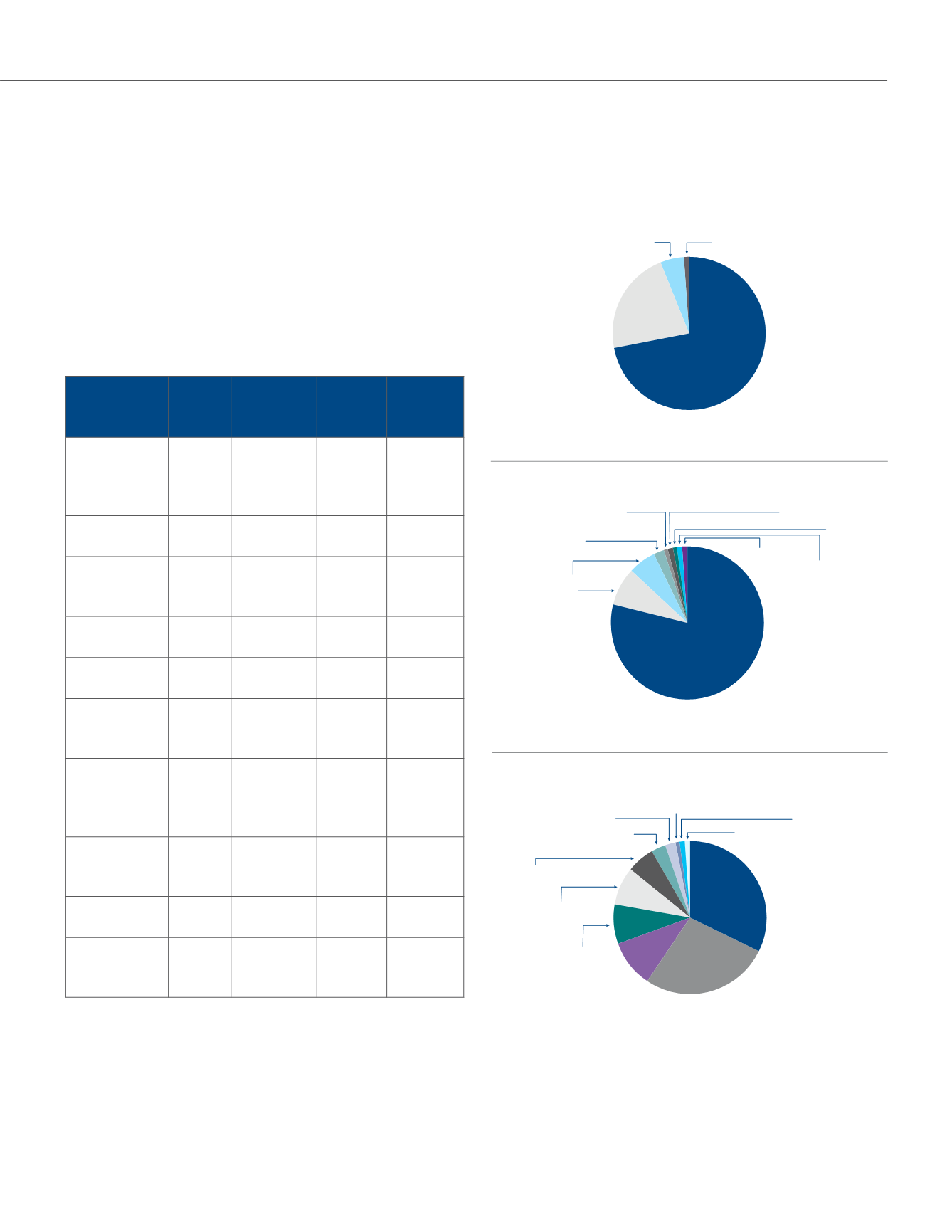

At the beginning of Q2 2016 the total reported value of

institutional holdings of DRs was $742 billion. Approximately

72% of the value of DRs is held by institutional investors in

North America while European institutional investors hold

around 22% of the value of DRs. In terms of investor type,

mutual funds accounted for roughly 79% of the DR value held.

In terms of investment style, growth and value investment

style funds accounted for around 59% of the DR value held.

Top Ten DR Holders

1

Holder Name Region Investment

Style

2

Investor

Type

Value of

DRs Held

(USD Billions)

Fidelity

Management

& Research

Company

North

America

Growth Mutual

Fund

$19.1

Capital World

Investors

North

America

Value

Mutual

Fund

$16.9

Baillie Gifford

& Company,

LTD

Europe Growth Mutual

Fund

$14.1

Dodge & Cox North

America

Deep Value Mutual

Fund

$13.0

Fisher

Investments

North

America

GARP Mutual

Fund

$12.5

T. Rowe Price

Associates,

Inc.

North

America

Growth Mutual

Fund

$12.1

Capital

Research

Global

Investors

North

America

GARP Mutual

Fund

$11.6

Dimensional

Fund Advisors,

L.P.

North

America

Value

Mutual

Fund

$10.7

BlackRock

Fund Advisors

North

America

Index

Mutual

Fund

$9.7

Lazard Asset

Management,

LLC

North

America

Value

Mutual

Fund

$9.7

Source: Ipreo

1

Data as of Q1 2016.

2

GARP funds: growth at a reasonable price (GARP) investors hold securities that are trading at a discount to the market, but are expected to grow at a higher

rate than the market or industry average. These companies are typically out of favor systematically or temporarily. This is a more conservative investment style

compared to an outright growth-oriented strategy. Dividend yield is generally not a concern of GARP investors.

3

Institutional investors from the Middle East, Africa and Latin America constitute less than 2% of the total value of DRs held.

By Investment Style

1, 2

By Investor Type

1

By Region

3

Top Institutional Holders of DRs

Pacific

1%

Asia

5%

Europe

22%

North America

72%

Other

1% Insurance

1%

Broker

1%

Investment advisor-fund of funds

1%

Sovereign wealth fund

1%

Pension fund-state/

government

2%

Investment manager

6%

Hedge fund manager

8%

Mutual fund

79%

Specialty

1%

Broker

1%

Yield

1%

Externally managed

2%

Aggressive growth

3%

Deep value

7%

Alternative

8%

Index

8%

GARP

10% Value

27%

Growth

32%

Source: Ipreo

Total Value of DRs Held: $742.5 Billion

Source: Ipreo

Total Value of DRs Held: $742.5 Billion

Source: Ipreo

Total Value of DRs Held: $742.5 Billion